Published 19.6.2024

More than half of the world’s GDP (Gross Domestic Product) is fairly or highly dependent on ecosystem services provided by nature. Most businesses rely on natural capital as part of their value chains. The impacts of businesses on nature and the effects of nature-related risks on business operations are thus increasingly interesting to financiers, because, similar to climate change, they can lead to economic impacts on investments.

Economic Valuation of Nature Impacts

In recent years, the Task Force on Nature-related Financial Disclosures (TNFD) framework has been developed to understand and economically value nature impacts. The idea is to help the financial sector assess and report on nature-related risks and opportunities as part of financial reporting.

The TNFD (Task Force on Nature-related Financial Disclosures) framework is intended for financial sector actors, such as businesses, investors, banks, and insurance companies. TNFD has been created similarly to the Task Force on Climate-related Financial Disclosures (TCFD), but it focuses on nature and nature-related risks and opportunities. TNFD’s goal is to help investors and businesses better understand nature-related risks and their economic impacts, as well as to promote transparency and reporting in these matters. The initiative is backed by a group of international financial institutions, companies, and state organizations. Development began in 2021, and the framework’s guidelines were published in September 2023.

Once implemented, the TNFD framework is expected to encourage financiers and businesses to understand and manage nature-related risks and opportunities in a way that leads to more sustainable operations and better conservation measures.

TNFD focuses on the economic valuation of nature impacts, considering the organization’s impacts on biodiversity, ecosystems, and natural resources. At the same time, it also considers the economic impacts of a company’s dependence on nature. Organizations are encouraged to report on their dependencies and impacts on nature and biodiversity, as well as the measures taken to manage risks and leverage nature-related opportunities. Reportable factors include biodiversity loss, habitat degradation, pollution, resource use, and ecosystem services.

TNFD aims to develop indicators and targets that help organizations measure and report nature-related risks and opportunities consistently. These indicators and targets help financiers, lenders, and other stakeholders assess the economic impacts of nature factors across different sectors and geographic areas.

TNFD emphasizes integrating nature issues into existing financial frameworks, risk management processes, and decision-making systems. This way, organizations can make more informed decisions and allocate capital towards nature-positive activities. The goal is a global standard for economic reporting on nature impacts, promoting the exchange of information across sectors and regions and enabling cooperation among different actors.

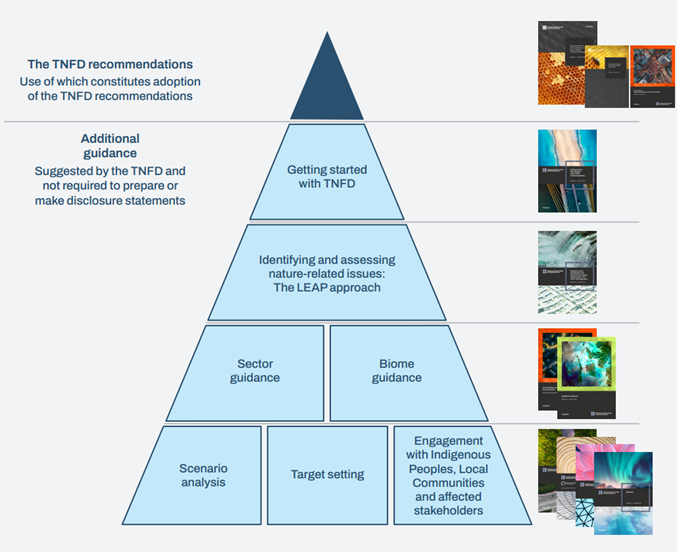

Available TNFD Guidance. Source: Taskforce on Nature-related Financial Disclosures (TNFD) Recommendations – TNFD

Would you like assistance with assessing nature impacts and setting targets? Take contact!